“Uninstall the fund app and focus on other things.”

How to Deal with the Continuous Decline of Funds?#

Actually, you don't need to be too anxious or worried.

【First】 you need to understand:

- The stock market cannot always be on the rise; fluctuations are natural;

- If you sell, that loss is inevitable;

- If you want to switch to another fund, can you guarantee that it won't be a worse fund?

- If you switch every time it drops, how much energy will you spend? Is it worth it?

- Have you considered the significant costs incurred by frequent trading?

【Then】 don’t rush to redeem it, here are more reasons:

- For example, from 1925 to 2002, in the 77 years of U.S. stock trading history, if you continuously invested for any 10 years, the chance of loss is 3%, while if you invest for just 1 year, the chance of loss is 30%;

- Excellent fund managers and fund companies should be more anxious than you;

- Unless there are significant changes in the fund company or manager, generally, you should evaluate and switch at least every six months;

- Believe that the world is always getting better [this is an old optimistic thought].

【Of course】 you must pay attention to the initial selection of funds: [I believe that the preparation work for selecting funds initially is more critical than the maintenance later]

- Refer to Morningstar to configure a fund portfolio suitable for you;

- Choose to invest in areas you are familiar with, rather than following the trend to speculate;

- You are using spare money, and even if you lose it all, it won't affect your quality of life.

If you want to read more, you can continue below — the source of the above thoughts is also accompanied by a mind map of the entire book.

Recommended Book — "Interpreting Funds"#

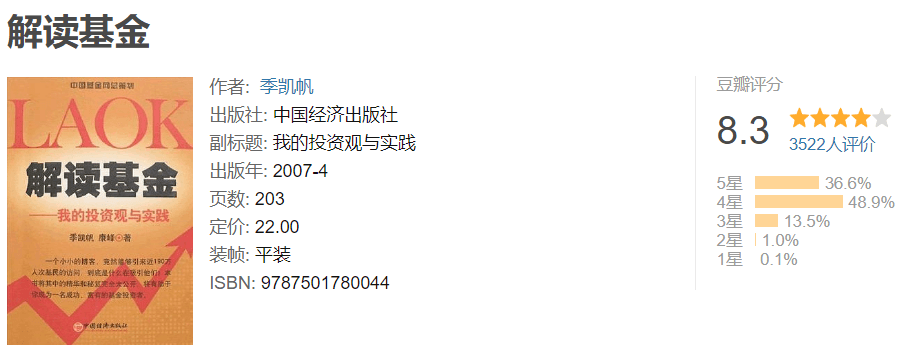

First, let’s share the Douban rating:

Starting from the book "The First Five Years of Work," it sparked my interest in financial management; then to Charlie Munger's "Poor Charlie's Almanack," I strongly agree with Master Munger's diversified thinking; followed by "Money Dog" and "Rich Dad Poor Dad," I realized the necessity of economic thinking on a macro level; until this practical sharing book on funds.

Mind Map#

Among them, the points that inspired me the most are marked in the image below: Use spare money, invest long-term, rebalance, Morningstar...

%25E3%2580%258A%25E8%25A7%25A3%25E8%25AF%25BB%25E5%259F%25BA%25E9%2587%2591%25E3%2580%258B%25E6%2580%259D%25E7%25BB%25B4%25E5%25AF%25BC%25E5%259B%25BE.png&w=3840&q=75)

I highly recommend reading this book yourself; the article is easy to understand and will provide fund beginners with a systematic understanding of funds.

【Finally】 I wish everyone finds an investment strategy that suits them, and invest steadily, bit by bit.

Download Link#

"Interpreting Funds: My Investment Views and Practices (Second Edition)" editable version

There are two versions: ① Original version (suitable for personal reflection), ② Self-marked version (suitable for quickly browsing key points)

Link: https://pan.baidu.com/s/1B6dT_F0-Rrx8nU-2BT6iQA

Extraction code: 36ia